Companies You Should Care About #5: MicroAcquire – everything you need to buy and sell startups.

Welcome to issue #5 of Companies You Should Care About, where we explore interesting companies and founders worth following.

Let’s say you want to own your own business. How would you go about doing that? Well, you could start one, but that’s pretty risky. Or you could inherit one, but that requires you to come from a fairly statistically unlikely family. Or you could buy one…That last option isn’t one most people would think of. But it’s more common than you might expect.

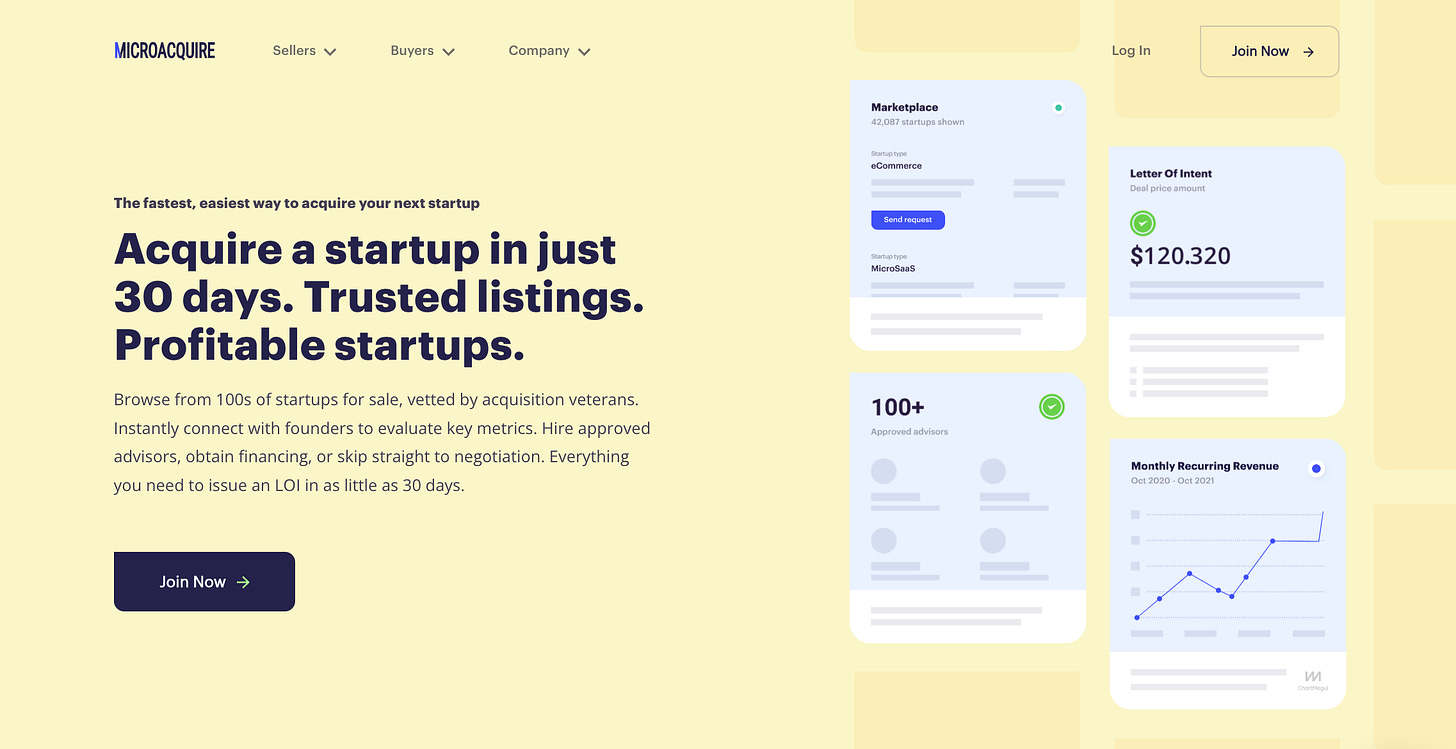

In this edition of Companies You Should Care About, we’re looking at MicroAcquire–a marketplace where entrepreneurs buy and sell startups. Let’s dive in!

But first, why should you care? TL;DR: The day they sell their business is often one of the most important days in an entrepreneur’s life. But ask most people how to buy or sell a business and they’ll shrug. Ask most founders the same question and you’ll probably get the same reaction. Who really knows? This stuff is was confusing. MicroAcquire is making the process of buying and selling businesses more transparent, trustworthy, and enjoyable for thousands of entrepreneurs.

Quick Stats 🚅

Year founded: 2020

Number of founders: 1

Category: Marketplaces

HQ: San Francisco, CA

Total funding: $11.3M

Annual Revenue: $2-3M (estimated)

Background stuff 📚

In 2018, Andrew Gazdecki had one of the most life-changing events an entrepreneur can experience: he sold his company. For the previous 8 years, Andrew and his team had built Bizness Apps into the most prolific mobile app developer in the world. An exit like that is a huge moment of celebration.

But, before the champagne could be opened, the sale had to be closed. For Bizness Apps, that meant spending hundreds of thousands in legal and investment banking fees and sinking thousands of hours into the process. The outcome was incredible, but the journey to get there left a lot of room for improvement.

Andrew’s experience probably sounds familiar to anyone else who has sold a company. It’s a bit like buying or selling a house. It’s not something people do very often, the process is confusing and unclear, and you often end up relying on pricy outside advisors to get the deal done. One of the biggest differences is that, with a business, you can often add a few zeros to the end of the transaction price. Put simply, the stakes are high.

Looking back, it’s easy to see how the idea that would become MicroAcquire could form from Andrew’s experience selling Bizness Apps. But at the time it wasn’t so obvious.

Andrew went on to start and sell a second company and join a third as CRO before starting MicroAcquire as a side project in 2020. And not just any side project. A side project without a business plan or any way to make money. A side project that Andrew quit his job to pursue when revenue was still $0.

So it’s easy to see how it became a success!

What? No.

Andrew himself has said he basically willed MicroAcquire into existence.

Fortunately, at its core is a pretty killer insight. Many more companies are being started every year (something we’ve talked about before), which means more businesses will eventually come up for sale. That’s great, except the selling process is mired in all the problems previously mentioned. Where there’s a problem there’s an opportunity, and while some other marketplaces were founded to address this problem, most of them approached it from the perspective of the business buyer, not the seller.

So Andrew took the opposite approach. With MicroAcquire he set out to build the most founder-friendly marketplace to buy and sell businesses. MicroAquire’s rapid success is a testament to that original insight, but also to a triumph of grit. In the early days, Andrew was the only employee—working from 5am to midnight on everything from business development and customer onboarding to marketing and customer support.

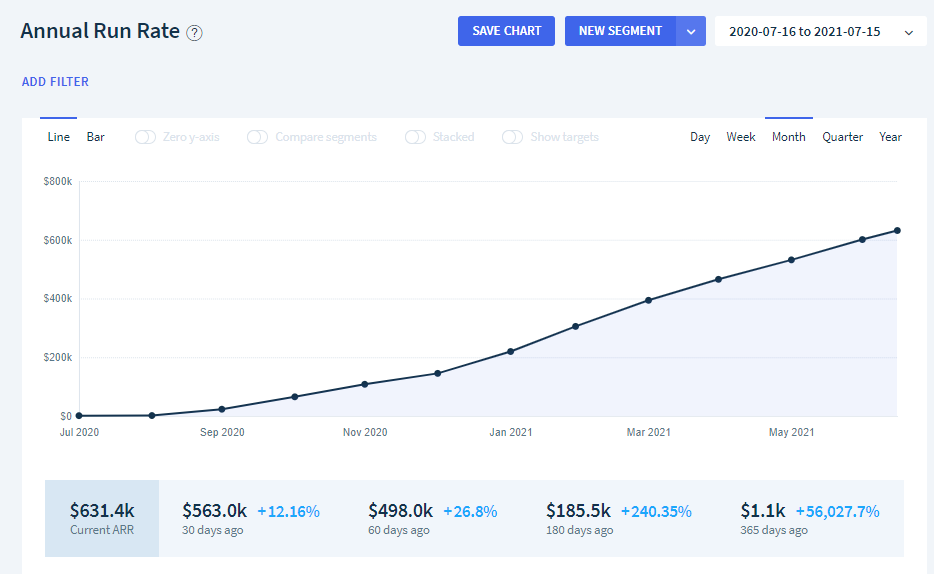

Fortunately for him, Andrew was able to hire a team fairly quickly—bringing on many people from his past projects—and delegate some of that work. Within 6 months MicroAquire passed $250K in ARR. After a year they topped $600K.

In that time, MicroAcquire saw over 1000 startups listed on the site, led to more than 300 acquisitions with +$100M in total deal volume, and registered +70,000 users. Oh, and they’re profitable.

How MicroAcquire Works 📊

If you made it through the background section you just saw some impressive numbers about MicroAcquire’s growth at the end. It’s an impressive product. But how exactly does MicroAcquire work?

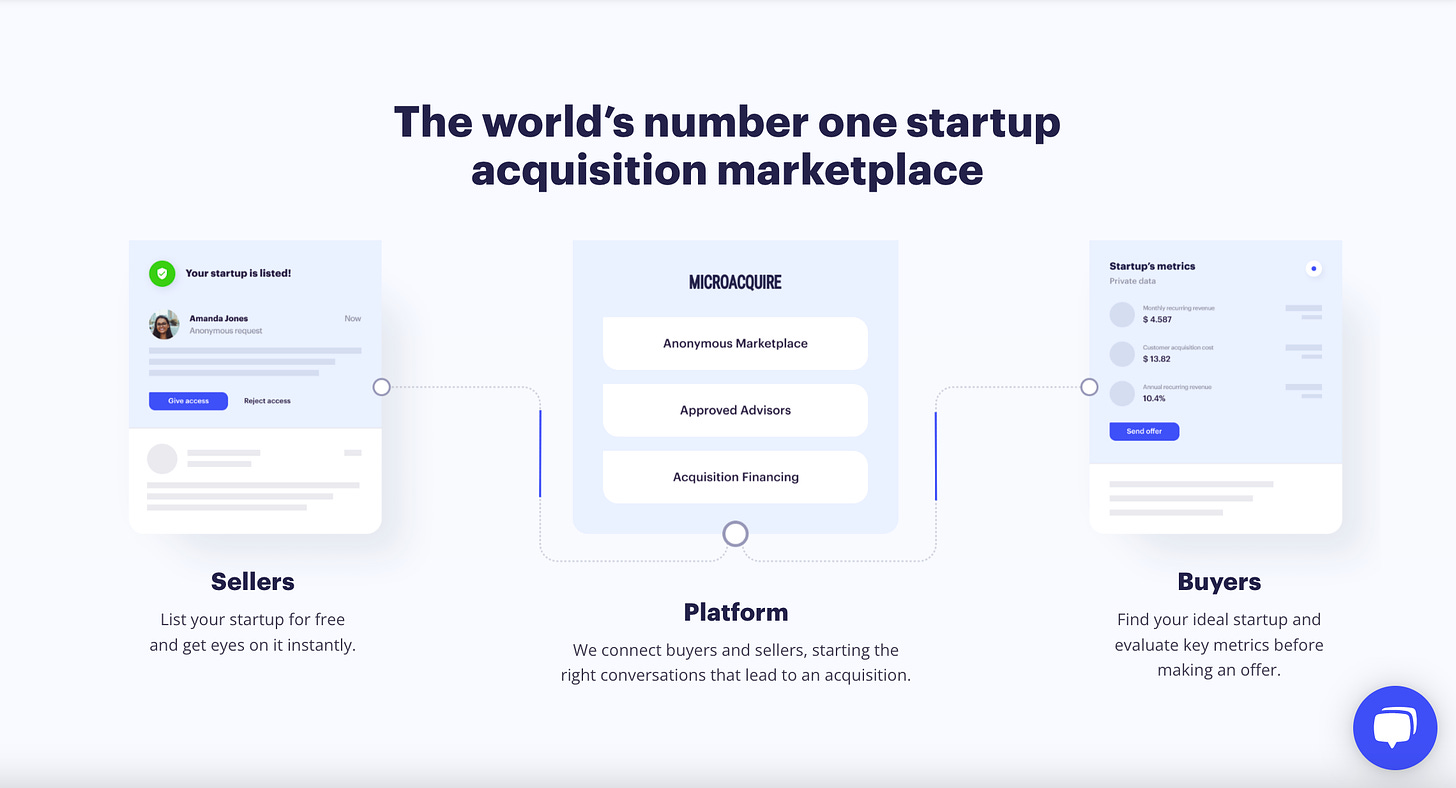

MicroAcquire has two main sets of users: owners who want to sell their businesses and buyers who want to purchase a business. At its most simple level, MicroAcquire brings those audiences together so they can transact with each other.

Weird things can happen when employees or customers learn a business they work for or use is up for sale. To solve that issue, all of the listings on MicroAcquire are anonymized. Potential buyers can see some basic facts like the category, revenue, and a short description of the company, but no identifiable names or info. Each listing is vetted before it’s posted on the site, which means there’s a lot more information about each company stored in MicroAcquire’s database. To get that valuable info, buyers contact the seller and have to be approved to see the more details.

It’s totally free to browse the anonymized listing but, to contact sellers, you’ll have to subscribe to an annual plan—priced at either $390 or $780 a year. It may sound counterintuitive, but this friction in the buying process is actually intentional. The annual subscription is priced high enough that only serious buyers will sign up—saving sellers the trouble of sorting through dozens of unqualified inquiries.

If they chose to, sellers can also have the MicroAcquire manage the entire process for them—handling legal guidance, marketing, deal evaluation and other advisory services for 5% of the transaction price.

MicroAcquire has also created a marketplace of over 100 qualified advisors, like legal and tax experts, to help with the transaction process and charges those advisors a fee for each lead they get through the site.

Why I’m excited 🤩

There are volumes of great information and tools to help with starting and growing a business. But the critical step of selling that business has largely been ignored—until now. And, underlying MicroAcquire’s growth is a rising trend towards more M&A.

For venture backed companies, over 90% now exit through an acquisition vs. an initial public offering. But that’s just the beginning.

Founder Andrew Gazdecki has said many times that venture funding doesn’t make sense for most companies, something I agree with. The thousands of bootstrapped businesses posting on Indie Hackers or featured in Starter Story show that it’s possible to build profitable businesses without taking on external money. Of course, the flip side of that is that most of these bootstrapped companies will never grow to a size where an IPO is even an option. But these are still great businesses where M&A as an exit path makes a lot of sense.

By reducing fees and making the selling process much easier, MicroAcquire is enabling this next generation of entrepreneurs to realize more value from the businesses they are creating.

On the other hand 🖖

It was challenging to think of risks for this one, but here are two.

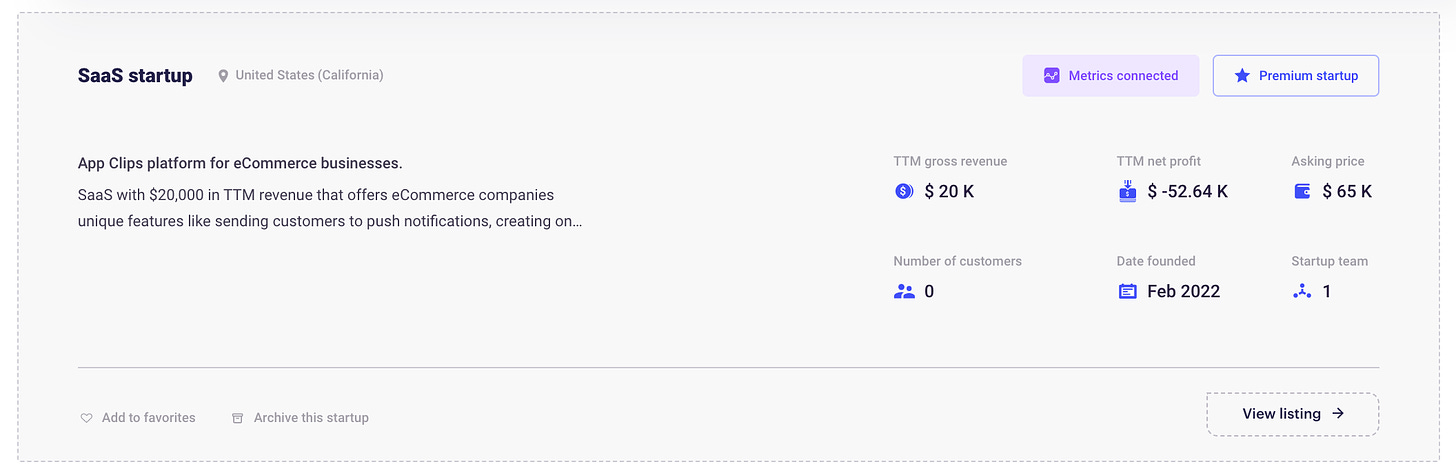

As MicroAcquire has grown, they’ve started to attract interest from larger private equity funds and institutional buyers. With professional teams entering the marketplace, it could become more difficult for small buyers to compete. That imbalance could reduce competition and lead to lower exit prices on MicroAcquire, which would make it a less attractive option for potential sellers.

A second risk is that MicroAcquire’s ideal seller is a small to mid-sized software business, which limits their market size. For larger companies looking to sell, it probably makes more sense to hire a bank and go through the traditional M&A process. Now that could change! But, for now, MicroAcquire is somewhat capped from working with the top end of the market.

Overall though, I think MicroAcquire is creating an exciting product that will only grow stronger as they onboard more and more buyers and sellers.

Go one deeper 🐟

MicroAcquire founder Andrew Gazdecki has done several in-depth interviews that informed this post. You can find more of those here and here.

He’s also shared a some helpful information in AMAs on Indie Hackers here and here.